As businesses expand across borders, managing compliance becomes a critical aspect of operations.

Microsoft Dynamics 365 Finance and Operations (F&O), a leading ERP solution, empowers large enterprises to streamline their financial and operational workflows.

However, ensuring compliance with ever-changing regional regulations, particularly in Europe and North America, remains challenging for enterprises relying solely on manual processes.

This is where Electronic Data Interchange (EDI) comes into play. EDI automates the exchange of critical business documents, such as invoices, purchase orders, and shipping notices, in standardized formats.

EDI integration with Dynamics 365 F&O helps businesses not only enhance operational efficiency but also ensure seamless adherence to regulatory frameworks across multiple regions.

As businesses navigate the complexities of GDPR, VAT reporting in Europe, and tax regulations in North America, EDI serves as an indispensable tool for maintaining compliance without compromising productivity.

Compliance Challenges for Businesses Using Dynamics 365 F&O

Multi-Country Operations

Global businesses often face a maze of regulations that vary across countries.

Dynamics 365 F&O users managing operations in different regions must align with unique invoicing, tax, and data privacy laws.

Failure to comply can result in penalties and damaged reputation.

Real-Time Reporting Requirements

Countries like Spain and Italy mandate real-time VAT reporting, while others demand immediate reconciliation of transactions.

This creates pressure to maintain accurate records and submit reports within strict deadlines.

Data Privacy Regulations

In Europe, businesses must adhere to GDPR requirements, ensuring secure data storage and exchange.

Any breach or non-compliance can lead to hefty fines.

High Volume of Transactions

Enterprise-scale businesses process thousands of transactions daily.

Manual handling increases the risk of errors, delayed submissions, and non-compliance with trading partner requirements.

Industry-Specific Requirements

Different industries have unique compliance mandates.

For instance, manufacturers must adhere to labeling standards, while retailers face vendor-specific EDI requirements from partners like Walmart or Target.

Regulatory Requirements Addressed by EDI in Europe

E-Invoicing Mandates

The EU Directive 2014/55/EU has made e-invoicing mandatory for B2G (business-to-government) transactions. Many countries have extended these requirements to B2B (business-to-business) operations.

For e.g. Denmark mandates NemHandel e-invoicing, while Italy uses the Sistema di Interscambio (SdI) for mandatory invoice submissions.

EDI ensures compliance with country-specific e-invoicing mandates by automating the creation, validation, and submission of invoices in the required format, reducing errors and ensuring seamless regulatory adherence.

VAT Reporting

Real-time VAT reporting is a growing trend in Europe. Countries like:

- Spain’s SII System: Real-time reporting within four days for VAT compliance uses e-invoicing.

- Hungary’s NAV System: Requires immediate reporting of certain invoice data.

- Italy’s SDI: Combines e-invoicing with near real-time reporting requirements for VAT.

- Greece’s MyDATA: Facilitates real-time reporting by processing e-invoicing data.

EDI ensures real-time reporting with no delays or errors.

Data Protection and GDPR

“Data protection is a fundamental right, protected not only by national law, but also by European Union law.”

– European Union Law

EDI solutions encrypt data and comply with GDPR, ensuring safe cross-border data exchange.

Industry Compliance

In the pharmaceutical sector, the EU requires traceability for medicines under the Falsified Medicines Directive (FMD).

EDI enables compliance by automating the creation and sharing of batch numbers, expiration dates, and other data with regulators and supply chain partners.

In the automotive sector, compliance with industry regulations such as the European Union’s REACH (Registration, Evaluation, Authorisation, and Restriction of Chemicals) regulation is critical.

By automating data exchange, EDI also ensures that the information provided is accurate and up-to-date, which is crucial for avoiding potential fines or delays in the manufacturing process.

Regulatory Requirements Addressed by EDI in North America

Tax Compliance

The U.S. and Canada have complex tax structures with state-specific regulations.

- Sales Tax: EDI ensures accurate sales tax calculations for U.S. businesses by automating compliance with state-level variations.

- GST/HST in Canada: EDI automatically calculates and reports goods and services tax for compliant invoicing.

Supply Chain Standards

North American retailers like Walmart, Amazon, and Target impose strict compliance requirements on their suppliers, including:

- Use of specific EDI formats (e.g., X12).

- Standardized shipping labels with barcodes.

Failure to comply can result in fines or loss of partnership.

EDI integration ensures suppliers meet these stringent requirements by automating document generation, validating data accuracy, and producing compliant shipping labels.

Trade Agreements

With the United States-Mexico-Canada Agreement (USMCA), businesses engaged in cross-border trade must submit compliant customs documents.

EDI automates the preparation and submission of these documents, minimizing delays.

Audit Preparedness

EDI helps businesses maintain a robust digital audit trail, ensuring readiness for tax audits and inspections.

Key Benefits of Dynamics 365 F&O EDI for Compliance

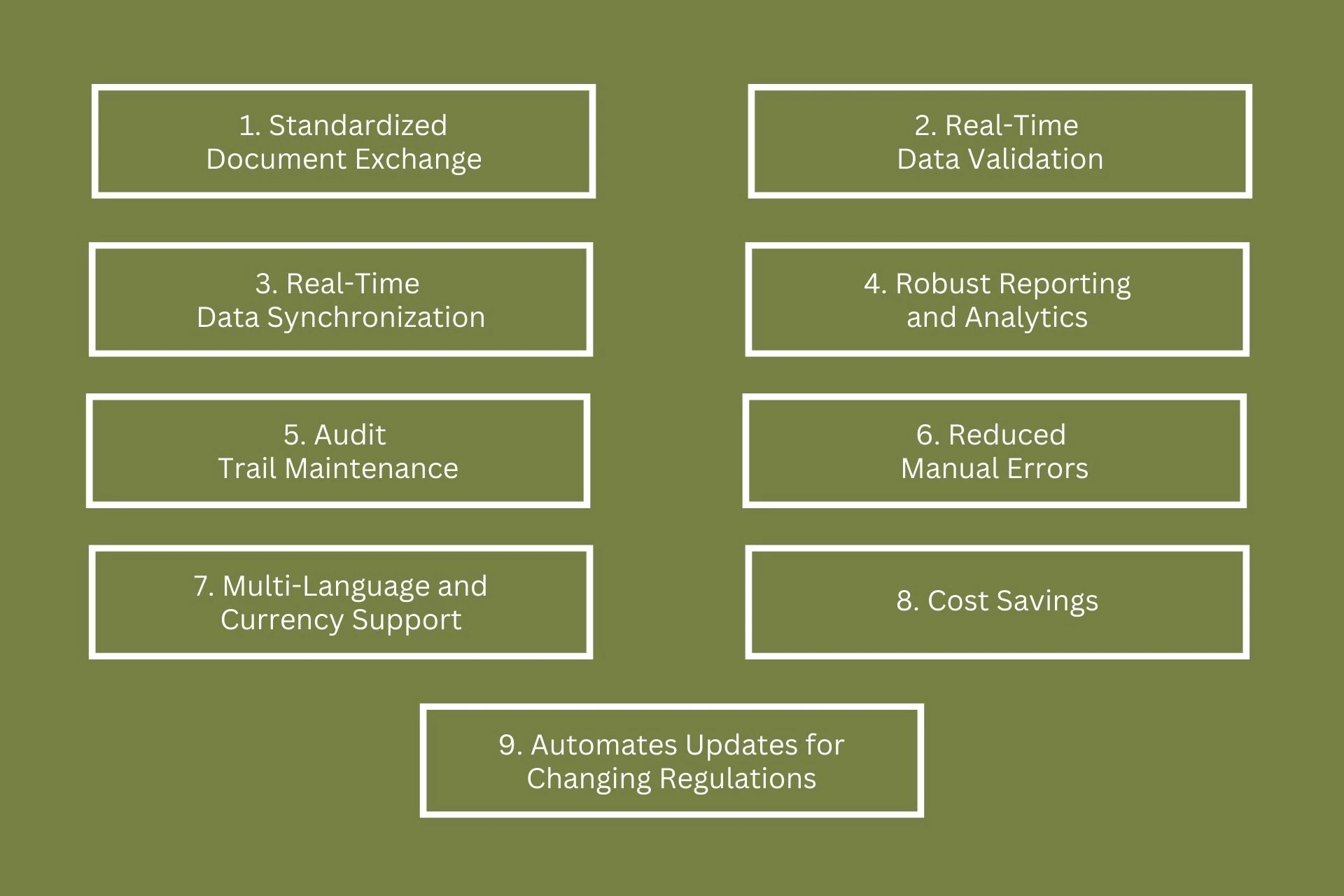

1. Standardized Document Exchange

EDI converts business documents into globally accepted formats like EDIFACT or X12, ensuring seamless data exchange between trading partners and compliance with local regulations.

2. Real-Time Data Validation

Automated validation ensures transactions meet regulatory requirements before submission, reducing rejections and penalties.

3. Real-Time Data Synchronization

Seamless integration ensures that transactions are validated and submitted in real time, keeping users up to date with tax authority’s and trading partners’ requirements.

4. Robust Reporting and Analytics

With advanced reporting tools, businesses can monitor transactions for discrepancies, prepare for audits, and generate compliance reports with ease.

5. Audit Trail Maintenance

EDI automatically logs every transaction, providing a complete audit trail for compliance reviews. This eliminates the risk of lost or incomplete records.

6. Reduced Manual Errors

Manual data entry is prone to errors, which can lead to non-compliance. EDI automates data transfer, reducing errors and improving accuracy.

7. Multi-Language and Currency Support

For businesses operating across Europe and North America, EDI integration supports multiple languages and currencies, ensuring compliance with localized regulations.

8. Cost Savings

By automating compliance tasks, businesses save costs associated with fines, manual labor, and operational delays.

9. Automates Updates for Changing Regulations

EDI providers frequently update their solutions to align with evolving regulations, such as VAT rule changes or new tax reporting mandates.

Industry-Specific Compliance Use Cases for Dynamics 365 F&O EDI Integration

Manufacturing

- Requirement: Adherence to labeling standards and quality certifications.

- Solution: EDI generates compliant shipping labels and certificates, ensuring products meet regional standards before export.

Example: A manufacturer in Germany uses EDI integration with Dynamics 365 F&O to comply with EU labeling directives and U.S. customs requirements for cross-border shipments.

Retail

- Requirement: Compliance with retailer-specific mandates like ASNs (Advanced Shipping Notices) and barcoded labels.

- Solution: EDI automates the exchange of order confirmations, invoices, and shipping documents with retailers like Walmart and Target.

Example: Denmark-based retailer having EDI integration with Dynamics 365 F&O ensures timely submission of ASNs for a U.K.-based supplier.

Logistics and Supply Chain

- Requirement: Accurate customs documentation for cross-border shipments.

- Solution: EDI automates the creation of packing lists, customs declarations, and bills of lading, reducing delays and fines.

Example: A Canadian logistics provider uses Microsoft Dynamics 365 F&O EDI to meet USMCA documentation standards.

Microsoft Dynamics 365 Finance and Operations is a powerful ERP for managing large-scale operations, but compliance remains a critical challenge for enterprises. EDI integration offers a transformative solution, automating compliance with regulatory standards in Europe, North America and other countries.

Discover how EDI integration with Dynamics 365 F&O can future-proof your business against compliance risks. Contact us today to explore our tailored EDI solutions and ensure seamless global operations.